Introduction: Why a Crypto Wallet Matters

In today’s fast-evolving financial world, cryptocurrencies are no longer just a trend. They have transformed into a global phenomenon that is reshaping digital payments, investments, and decentralized economies. But to enjoy the benefits of cryptocurrencies like Bitcoin and Ethereum, you must store and manage them securely. This is where the Crypto Wallet comes into play.

A Crypto Wallet acts as your gateway to the blockchain ecosystem—allowing you to send, receive, and safeguard your digital assets. Think of it as your personal digital bank account, but far more secure and under your exclusive control. Without a wallet, you cannot properly engage in cryptocurrency trading, transactions, or long-term investments.

This article will guide you step by step on how to set up your Crypto Wallet, ensuring it meets both your functional needs and security expectations.

What is a Crypto Wallet?

A Crypto Wallet is a digital or physical tool that securely stores your private keys—codes that prove your ownership of cryptocurrencies. Unlike a traditional bank wallet that holds physical money, a Crypto Wallet does not store coins directly. Instead, it holds security keys that allow you to interact with blockchains.

Key Functions include:

- Sending crypto – Transfer assets to other users across the globe.

- Receiving crypto – Safely accept digital payments or transfers directly to your address.

- Securing funds – Protect your tokens using strong encryption and private keys.

- Portfolio management – Track, view, and manage your cryptocurrency holdings.

Types of Crypto Wallets

Before setting one up, it’s crucial to understand the main types of Crypto Wallets:

1. Hot Wallets

- Connected to the internet.

- Convenient for regular transactions.

- Examples: Mobile wallets, Web wallets, Desktop wallets.

- Risk: Exposed to hacking if not secured properly.

2. Cold Wallets

- Offline storage, not connected to the internet.

- Ideal for long-term storage and large amounts of crypto.

- Examples: Hardware wallets (Ledger, Trezor), Paper wallets.

- Highest level of security.

3. Custodial & Non-Custodial Wallets

- Custodial Wallet: Third party (like an exchange) stores your keys. Convenient, but less secure.

- Non-Custodial Wallet: Complete control over your keys. Secure and privacy-focused.

Factors to Consider Before Setting Up Your Crypto Wallet

When choosing the right Crypto Wallet, keep these points in mind:

- Security Level: Do you need maximum protection (cold wallet) or convenience (hot wallet)?

- Coin Support: Some wallets only support Bitcoin, others multiple currencies like Ethereum, Solana, or stablecoins.

- Ease of Use: If you are a beginner, a mobile wallet with an intuitive interface is ideal.

- Backup & Recovery Features: Ensure there’s a recovery phrase to protect against device loss.

- Cost Factor: Hardware wallets usually cost money, whereas hot wallets are free.

Step-by-Step Guide to Setting Up Your Crypto Wallet

Follow these practical steps to create and secure your Crypto Wallet:

Step 1: Choose the Right Type of Wallet

Decide whether you want a hot wallet for daily use or a cold wallet for serious holdings. Beginners often start with mobile wallets like Trust Wallet or MetaMask.

Step 2: Download or Purchase

- For mobile/web wallets: Download from official app stores or websites.

- For hardware wallets: Buy only from authorized sellers (avoid second-hand due to security risks).

Step 3: Install and Launch the Wallet

Open the application or connect your hardware wallet. It will prompt you to either create a new wallet or import an existing one.

Step 4: Create a New Wallet

- Click “Create Wallet.”

- Create a strong password (avoid simple names or birthdays).

Step 5: Backup Your Recovery Phrase

This is the most important step. You’ll see a 12–24 word recovery phrase. Write it down on paper and store offline—never share it or take screenshots. Losing your recovery phrase means losing access to your Crypto Wallet forever.

Step 6: Secure Your Wallet

- Enable 2FA (two-factor authentication) if supported.

- Use biometric locks (fingerprint/Face ID) for mobile wallets.

- Keep backup copies of your recovery phrase in secure offline locations.

Step 7: Fund Your Wallet

- Purchase cryptocurrency on exchanges (such as Binance, Coinbase, or Kraken).

- Transfer it to your wallet’s public address (generated automatically).

Step 8: Test a Small Transaction

Before moving large amounts, test by sending a small token. This ensures you correctly understand how to send/receive.

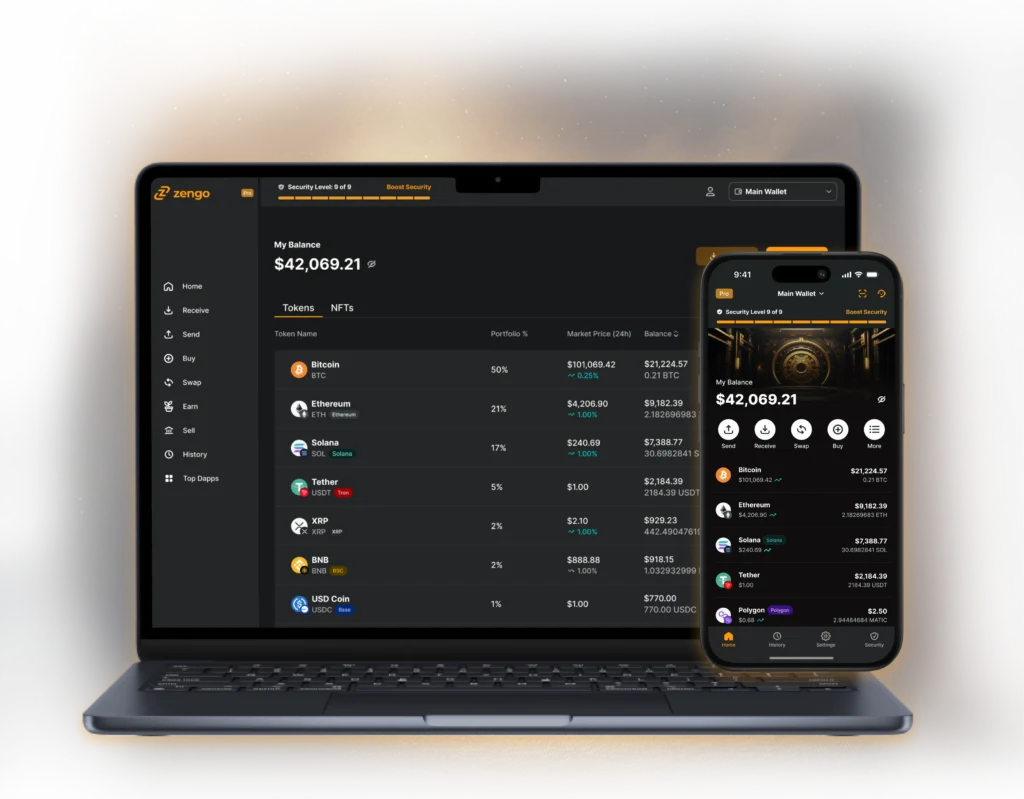

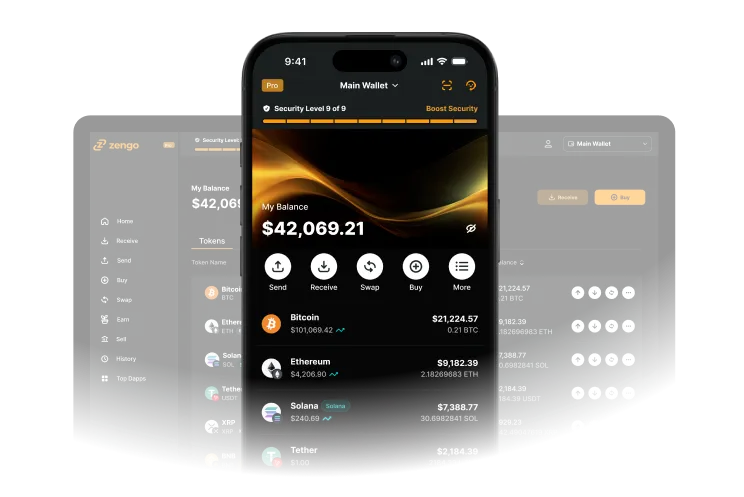

Step 9: Explore Wallet Features

Many wallets provide features like:

- Staking rewards for holding certain coins.

- NFT support for digital artworks and collectibles.

- Portfolio tracking and real-time price charts.

Best Practices for Maintaining a Secure Crypto Wallet

Security should always be your top concern. Here are tested strategies:

- Never share private keys – Anyone with your private key controls your funds.

- Use hardware wallets for large holdings.

- Keep your software updated – Always install the latest security patches.

- Beware of phishing attacks – Only use official wallet websites and links.

- Separate wallets for different purposes – Use one wallet for trading and another for long-term storage.

- Leverage a VPN when accessing wallets online to increase anonymity.

Common Mistakes to Avoid with Your Crypto Wallet

- Storing recovery seed in phone/gallery (hackers target this).

- Downloading wallets from unofficial websites.

- Ignoring small testing transactions when sending larger amounts.

- Using weak passwords.

- Forgetting to update software/firmware.

Popular Crypto Wallet Options in 2025

Here are some of the most reliable wallets as of today:

- Ledger Nano X (hardware) – Best cold wallet for professionals.

- Trezor Model T (hardware) – User-friendly cold wallet.

- MetaMask (browser & mobile) – Perfect for DeFi and Ethereum ecosystem.

- Trust Wallet (mobile) – Easy-to-use multi-asset wallet.

- Exodus Wallet (desktop & mobile) – Ideal for beginners with sleek design.

Future of Crypto Wallets

The future of Crypto Wallets goes beyond storage—they are evolving into digital financial super-apps. New features being integrated include:

- Direct fiat on-ramping (buy crypto with debit/credit instantly).

- Multi-chain interoperability.

- Integration with decentralized applications (dApps).

- Advanced biometric security (iris scan, hardware authentication).

A power keyword concept here is “Ultimate Security”—because tomorrow’s wallets will blend convenience with ultimate security that goes far beyond what conventional banking offers.

Conclusion

Setting up a Crypto Wallet is not as complicated as it may seem. Whether you’re a beginner experimenting with small amounts, or an investor safeguarding substantial digital assets, the right wallet is your key to accessing the decentralized economy safely.

By carefully selecting the right type, backing up your recovery phrase, enabling robust security measures, and avoiding common mistakes, you can manage your digital wealth with confidence.

As blockchain adoption grows, a Crypto Wallet won’t just be a secure vault for your coins—it will become an essential financial tool for everyday use. So, start small, stay cautious, and master this essential skill that could define the future of finance.