The foreign exchange market is the largest and most liquid financial market in the world. Forex exchange rate changes are a common phenomenon influenced by a variety of economic, political, and market-specific factors. Understanding these changes can empower traders, businesses, and investors to make smarter financial decisions.

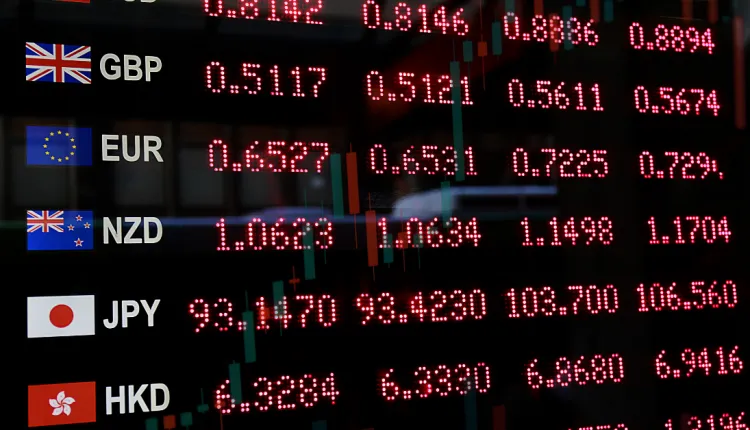

What is the Forex Exchange Rate?

The forex exchange rate refers to the price at which one currency can be exchanged for another. These rates are constantly in flux due to supply and demand dynamics, making them crucial indicators of economic health and international trade viability. A currency’s strength or weakness reflects the overall confidence in that country’s economy.

Key Factors Driving Forex Exchange Rate Changes

Several fundamental factors contribute to the dynamic nature of exchange rates. Recognizing these factors is vital for predicting future movements.

Inflation Rates

Countries with lower inflation typically see their currency value increase relative to others. Stable inflation maintains purchasing power, making the currency attractive. Conversely, higher inflation often depreciates a currency because it reduces its purchasing power overseas.

Interest Rates

Interest rates set by central banks have a direct impact on forex rates. Higher interest rates provide lenders with better returns, attracting foreign capital and causing a currency to appreciate. Lower interest rates, on the other hand, can lead to currency depreciation as capital seeks higher-yielding environments.

Economic Indicators and Political Stability

Economic performance indicators such as GDP growth, employment rates, and political events like elections or geopolitical tensions can dramatically influence exchange rates. Investors seek stable, prosperous environments, so instability often results in currency sell-offs.

Trade Balances and Capital Flows

A nation’s trade balance—the difference between exports and imports—affects its forex rates. A trade surplus typically strengthens a currency, while a deficit tends to weaken it. Additionally, capital inflows from foreign investments boost demand for a country’s currency.

How Forex Exchange Rate Changes Affect Global Markets

Fluctuations in exchange rates have broad implications beyond currency traders.

- Impact on Imports and Exports: A strong currency makes imports cheaper but can hurt export competitiveness by making goods more expensive overseas.

- Inflation Transmission: Currency depreciation can increase the cost of imported goods, pushing domestic inflation higher.

- Investment Decisions: Forex fluctuations impact the returns on international investments when converted back to the investor’s home currency.

Forex Exchange Rate Regimes

Countries adopt different exchange rate systems, influencing currency volatility and control.

- Fixed Exchange Rate: Governments peg their currency to a major currency like the US dollar, maintaining stability but sacrificing monetary policy autonomy.

- Floating Exchange Rate: Market forces determine the rate, leading to higher volatility but allowing monetary policy flexibility.

- Managed Float: Central banks intervene occasionally to stabilize or direct the currency without committing to a fixed rate.

Predicting Forex Exchange Rate Movements

Though forex markets are inherently volatile, factors such as economic data releases, central bank announcements, and geopolitical developments provide signals. Traders use fundamental analysis alongside technical indicators to forecast price changes.

Conclusion: Navigating Forex Exchange Rate Changes with Confidence

Understanding the complexities behind forex exchange rate changes is essential for anyone involved in international finance, trade, or investment. By focusing on inflation, interest rates, economic indicators, and trade balances, one can better anticipate market shifts. Utilizing strategic analysis and keeping abreast of geopolitical news enhances the ability to leverage forex market opportunities effectively.